- 13 Dec 2025

- 3 Minutes to read

- Print

- DarkLight

- PDF

Expected Behaviour from a Schedule

- Updated on 13 Dec 2025

- 3 Minutes to read

- Print

- DarkLight

- PDF

When you implement a schedule it is important to understand the behaviour of a schedule and how it will impact upon your Azure bill.

What you should typically expect

When you implement a schedule then you will be taking a set of resources and changing their billing status at points in time. A typical example would be you take a VM and change it from being on 24/7 to being on from 9am to 5pm 5 days a week.

This will be a change you implement one time when turning the schedule on and you will see a significant cost saving over the next 30 days compared to the previous 30 days and then this change is now permanent.

It is important to understand that you have reduced the base line cost but you will not see that reduction as a new saving every month.

Discussion Points

Below are some common observations and discussion points related to schedulers.

1️⃣ Actual cost drops once, then flat-lines

This is the most common misconception with a scheduler approach. You will not see huge month over month savings, you will see a base-line drop in your costs in month 1 and then a flat line if this reduction is maintained.

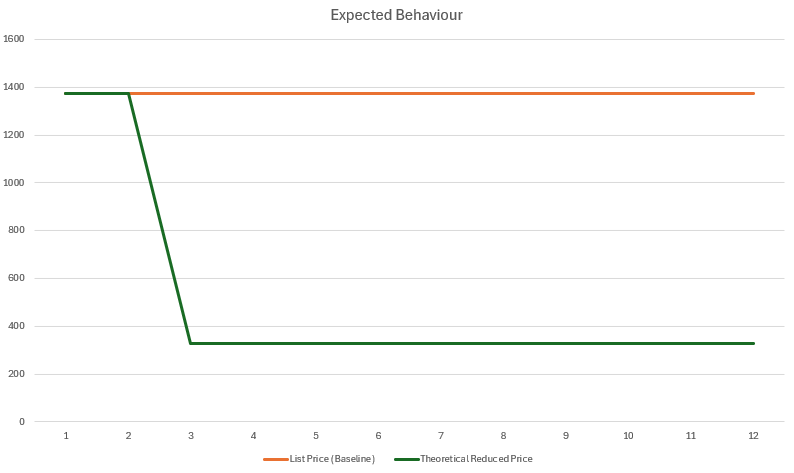

We are looking for a behaviour similar to what is shown in the below diagram.

An Example Observation

Month 1 (Jan): Cost = 1400

Month 2 onward: Cost = 375, every single month

No further month-over-month reduction after month 3

What this tells us

The scheduler created a step change

Once the new baseline was reached, there was:

No additional incremental savings

No regression either

This is exactly how schedulers should behave.

Key takeaway

The scheduler permanently reduced the run-rate.

It did not create compounding monthly savings.

Sometime you may misinterpret “flat” as “not working”.

2️⃣ “Additional savings vs last month” only appears once

Observation

When I look at the data I see something like the below

March shows 1025 savings

Every month after shows 0

Why this is important

This data point is the source of confusion.

Customers perceive:

Big theoretical savings every month

Zero “new” savings after month one

And conclude:

“The scheduler stopped saving us money.”

What’s actually happening

March captured the entire baseline drop

From April onward, the savings are already embedded

You are comparing a new steady state to itself

Key takeaway

Month-over-month deltas are the wrong metric for schedulers.

Schedulers should be measured by baseline reduction, not monthly variance.

3️⃣ Amortized cost aligns to the new baseline immediately

Observation

Amortized Cost equals 375 from January onward

It matches Actual Cost perfectly after the first drop

What this tells us

Reservations / Savings Plans are:

Either fully absorbed

Or fully reallocated elsewhere

Billing has stabilized around the new schedule-driven run-rate

This is actually a sign of a healthy state.

Key takeaway

Once amortization stabilizes, the environment is optimized.

4️⃣ I feel like I should be getting more cumulative savings

Observation

By Dec, Theoretical Cumulative Savings = 10,250

Monthly cost never drops below 375

Why this matters

The cumulative theoretical number is mathematically true but psychologically misleading.

Customers may think:

“We should be seeing thousands more in savings by now.”

But in reality:

The unoptimized costs for the 12 months would have been 16,800 (1400 × 12)

The cost you paid was 6550 (1400 × 2 + 375 × 10)

The savings were realised as a permanent reduction when the scheduler started

Not as accumulating cash month by month

Your savings in a given month are really relative to if you did no optimization activity and comparable to the month before you turned on the scheduler

Key takeaway

When you use a scheduler, cumulative savings need very careful framing when you talk to your stakeholders about them, or they:

Undermine trust

Create unnecessary billing conversations

Distract from the real win (lower run-rate)

In this case, when discussing the scheduler savings with someone in June you may be talking to people who are not feeling a month over month saving because the costs have flat lined. In this case they forgot that the base line drop happened in March.